Tp qube

TP qube is proud of its participation in the redaction of a research paper detailing a framework for selecting and adjusting foreign comparable companies. This research paper published by TPED gathers the views of academic professors and business economists on this topic. In collaboration with TPED members, TP qube conducted statistical modeling work bringing empirical evidence to this delicate question.

This blog post highlights the main findings of the article. For more detailed information, we recommend to read the article published on TPED website.

The application of the arm’s length standard is based on the use of comparable transactions or comparable companies. However, the quality and quantity of publicly available data on comparable transactions and/or comparable companies is highly diverse. For specific geographic regions (for instance in Africa) the data is very scarce. This lack of comparable companies in some regions is a well-known issue notably discussed by the Platform of Cooperation on Tax.

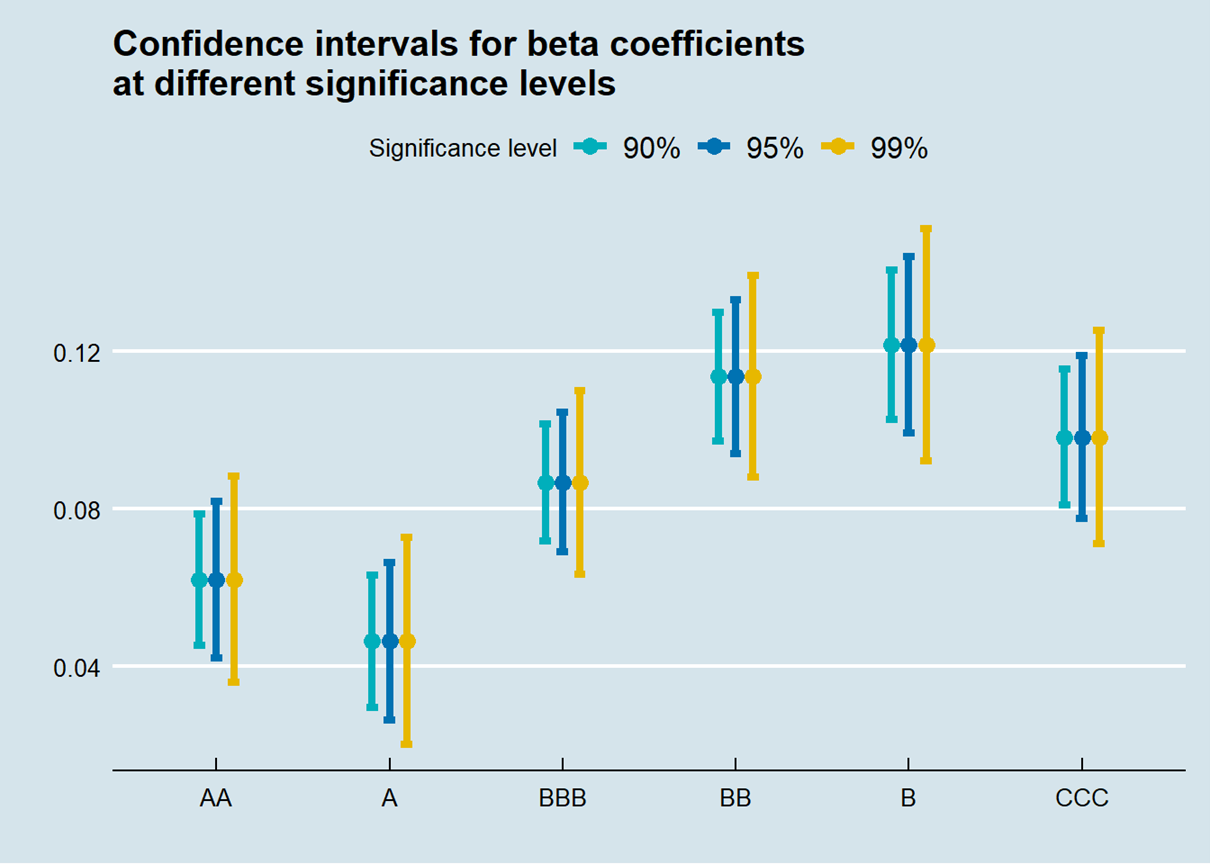

TP qube and TPED have analyzed the relationship between the profitability of a company and country-specific risks (proxied by the sovereign rating) for independent companies in the food processing sector. The main results can be summarized in the figure below:

For the food processing sector, the average profitability increases with the country risk (between the AAA and the BB ratings). This observed pattern is consistent with the common hypothesis of higher profitability levels in riskier countries. However, the B category shows a lower mean but also a very wide interquartile range. Econometric tests and OLS regressions find a statistical significant relationship between the risk of a company’s country and companies profitability. The region where a company is located does not seem to play a role as important. Hence, in the absence of domestic comparable companies, foreign comparable companies should not be rejected in principle, and there are merits in using foreign comparable companies from countries with a similar country risk profile. This observation challenges the common intuition and typical transfer pricing practice that comparable companies from the geographically closest neighboring countries are by definition superior to comparable companies from other regions.